More Belushi, Less Bezos

Ali Khan is a corporate ninja. He has a black belt

02 March, 2020One Word: “Compliance”

To hear Jamie Dimon tell it, regulation and the co

25 June, 2015Death Becomes Them

Elvis Presley boasts 12.4 million “likes” on Faceb

29 January, 2015Your Career as a Loss Leader

The day after Belgium defeated the U.S. in the Wor

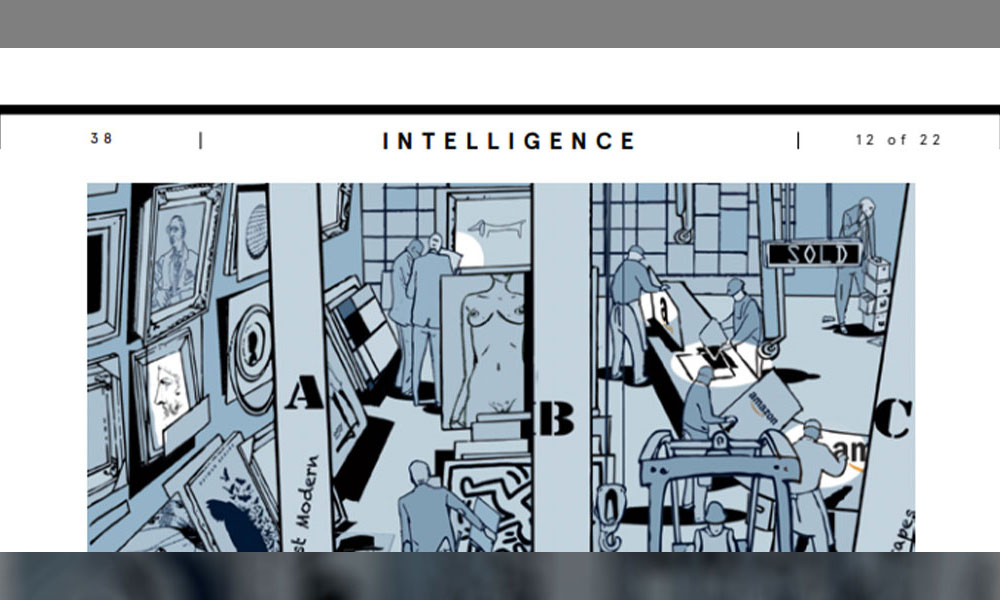

25 January, 2015Go Ahead, Add that $40,000 Jeff Koons to Your Cart

So, you’re ready to replace that poster from the M

12 January, 2015Citigroup, Unhedged

Vikram Pandit knows one way to make big money in h

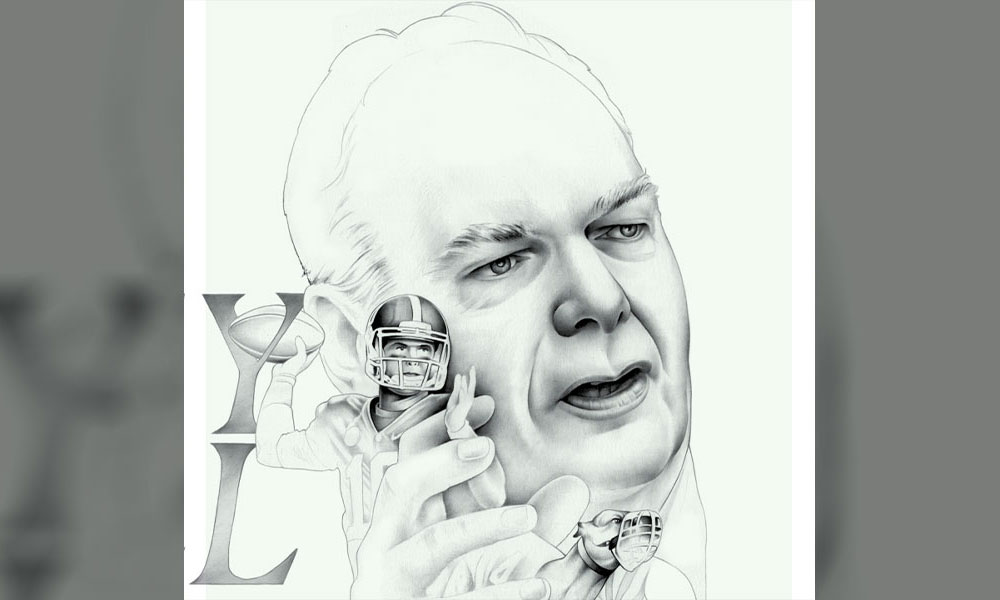

02 July, 2020Little Bear, Money Quarterback

The University of Alabama opened a new football-tr

02 July, 2020Wal-Mart Fights the Unions

As a supervisor of the cashiers in Wal-Mart store

02 July, 2020