- 27 November, 2022

Go Big, Like Ballmer, and Buy a Team

Got some spare cash from crypto trading? Consider

02 November, 2021The Electric Three-Wheeled Acid Test

Mark Frohnmayer is freaked out by climate change,

01 May, 2021The Inventor of Siri is Worried

As a psychologist, Tom Gruber is in awe of Faceboo

12 February, 2020Mark Zuckerberg Wants Your Brain

It’s tempting to view Roger McNamee as a rich guy

29 January, 2020A Rocket Among Zombies

Starting an exchange-traded mutual fund is a littl

26 August, 2015Keep Up the Intensity

For fun, Curtis Macnguyen likes to run along the s

10 June, 2020Money Formulas

Few people have profited more from the so-called s

04 August, 2020No Photos, Please

It’s hard to hide if you’re a hedge-fund billionai

02 February, 2015Smart People, Dumb Things

Brett Jefferson told his 5-year-old son this about

01 February, 2015Meditate and Grow Rich

When the markets took a dive in late January, hedg

15 January, 2015The Commodity King

Paul Touradji, commodity trader extraordinaire, on

02 July, 2020Eat, Pray, Pump Iron

Abilio Diniz can run backward. On a treadmill. In

02 July, 2020Robbins Earns 84% in a Year and Ice Skates in his Backyard

When Larry Robbins was a boy in the Chicago suburb

02 July, 2020Mark Rachesky Is Doctor Deal

Mark Rachesky, a Stanford University M.D. who’s ne

02 July, 2020Whale Slayer Looks for Next Kill

Andrew Feldstein, the Harvard-educated lawyer who

02 July, 2020Wall Street Numerology

Past the two Bentleys in the driveway and beyond t

02 July, 2020Sean Healey, His Hedge Funds, and the Million-Dollar Fish

One thing Sean Healey missed most when he left Gol

02 July, 2020Steve Cohen Can Play Golf, Too

In late January, billionaire Steven A. Cohen hoste

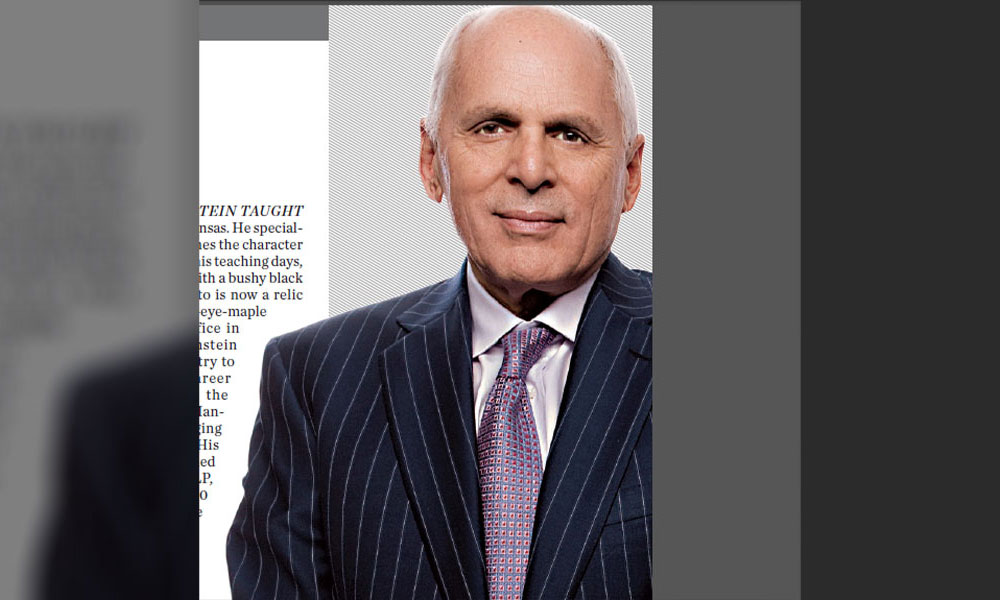

02 July, 2020Wasserstein’s Ghost

Bruce Wasserstein, dead for two years, still casts

02 July, 2020Falcone Blasts Money Into Space

Philip Falcone left his hometown of Chisholm in no

02 July, 2020Fairfax and the Hedge Funds

One morning in 2005, an unusual letter arrived for

02 July, 2020Duff Capital’s Bender Ends Badly

Phil Duff had a three-decade hot streak. He earned

02 July, 2020Mortgage Metaphysics

For 20 years, Don Brownstein taught philosophy at

02 July, 2020Chase Coleman Makes a Killing

Charles Payson Coleman III, known as Chase, is as

02 July, 2020Andy Beal, Texas Banker

Andy Beal’s road to becoming a billionaire, doing

02 July, 2020Citigroup, Unhedged

Vikram Pandit knows one way to make big money in h

02 July, 2020Alice Handy 1, Harvard 0

Prescient bets against the stock market have helpe

02 July, 2020Bob Sillerman, Wall Street Idol

Media baron Robert F.X. Sillerman had a great run

02 July, 2020The World’s Pain Is Paulson’s Gain

The subprime crisis that’s caused so much trauma f

02 July, 2020Pirate Tom

Tom Hudson and his pirates had a blunt message for

02 July, 2020Playing the Odds

One day in Chicago, Dave Bigg is about to drink a

02 July, 2020